The Seafood Stewardship Index (SSI) is a benchmark developed by the World Benchmarking Alliance to assesses the 30 most influential companies in the seafood sector on a set of social, environmental and governance criteria that are aligned with the Sustainable Development Goals (SDGs) and international private sector standards and frameworks relevant for the seafood industry (e.g., Marine Stewardship Council, Global Dialogue for Seafood Traceability standards). The methodology and associated scoring guidelines can be found on WBA’s website.

The companies assessed include companies from Asia, Europe and North America, that have activities in different parts of the value chain including aquafeed production, aquaculture, fishing, processing, branding and trading. The list of companies assessed in the SSI can be found here.

The first SSI was released in October 2019. Since then, 2 more iterations of the SSI were published in October 2021 and October 2023.

The 2023 Seafood Stewardship Index shows that companies have made progress on certain topics such as improved transparency and reporting, continued engagement on environmental aspects of seafood sustainability and participation in pre-competitive efforts.

For example, 28/30 companies source at least one product from operations that are sustainable or making improvements. More companies are making commitments to environmentally sustainable, socially responsible and traceable seafood products. For instance, since 2019, 5/30 additional companies have started to implement the first steps of human rights due diligence, bringing the total to 7/30. A growing number of companies have also implemented grievance mechanisms for workers and external individuals and communities. Furthermore, more companies (24/30) now have a public commitment to traceable seafood.

However, there is still a long way to go for companies to address their social and environmental impacts across their entire operations and/or supply chains and comprehensively report about their progress.

To start with, too few companies seem to have assessed and identified their environmental and social risks across their entire operations and/or value chain, which is the first step before setting targets. This probably explains why even though companies are making commitments, too few companies are setting specific, measurable and time-bound targets.

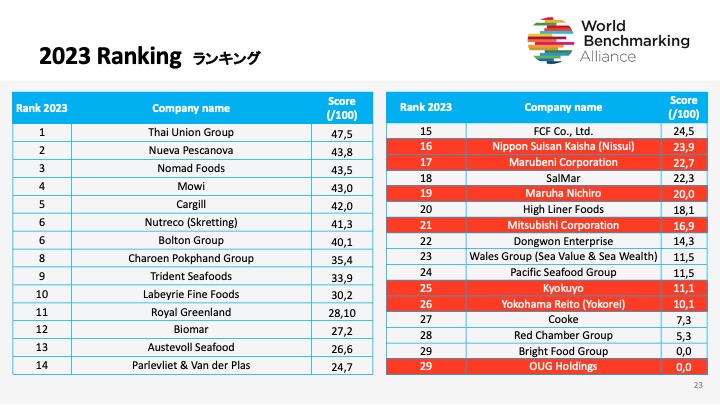

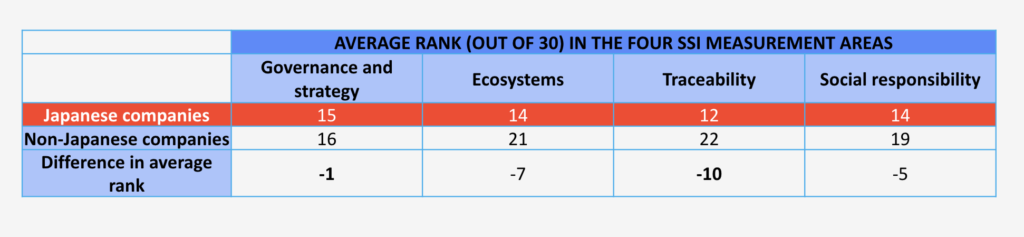

There are 7 Japanese companies assessed by the Seafood Stewardship Index (Nissui, Marubeni Corporation, Maruha Nichiro, Mitsubishi Corporation, Kyokuyo, Yokohama Reito and OUG Holdings). Overall, Japanese companies have remained at the bottom half of the ranking since 2019.

Figure by World Benchmarking Alliance

Figure by World Benchmarking Alliance

However, these have made significant improvements in their absolute scores, especially Marubeni and Nissui who respectively improved by 13,0 and 5,3 points between 2021 and 2023, mainly due to improved disclosure and improved scores on governance, environmental and social responsibility topics. However, Japanese companies continue to lag behind their European and North American counterparts on traceability topics, with very limited or not disclosure on their targets and activities.

There are many challenges for seafood companies to address their social and environmental impacts. Moreover, the SSI assesses different kinds of companies so the challenges they face are different depending on their size, their target markets, level of vertical integration, whether focused on aquaculture or wild capture products, the legislative and culture context they operate in as well as the number of species and suppliers they deal with.

However, one shared challenge in the coming years will be to eradicate Illegal, Unreported and Unregulated (IUU) fishing, which is a risk found in both aquaculture and wild capture fisheries supply chains. With 1/5 fish caught from IUU operations in the world and IUU operations being linked to human rights risks, IUU is a significant threat to the sustainability of the industry. Companies can play a pivotal role in the fight against IUU through improved traceability.

A challenge faced by Japanese companies more specifically is associated with the fact that they deal with a wide diversity of seafood products and a large number of supply chains. This means that assessing and addressing environmental and social impacts associated with those products is a monumental task but not an impossible one.

Indeed, in the last version of the SSI, we saw some Japanese companies (e.g., Marubeni) have started to map the environmental performance of their seafood products. This step is essential and will require significant investment as well as strong partnerships with relevant experts and NGOs, such as Seafood Legacy, that can support this process. Japanese companies represent a huge percentage of global seafood production and have started the journey towards sustainable seafood. We hope to see accelerated progress in the coming years.

More details about the results of the 2023 Seafood Stewardship Index can be found in the 2023 Seafood Stewardship Index insights report. The full data set of the 2023 SSI can be found here.

Written by: Helen Packer

Seafood Stewardship Index Lead, Engagement, World Benchmarking Alliance

-1024x606.png)

_-1024x606.png)

1_修正524-1024x606.png)

.2-1024x606.png)

2-1024x606.png)

-1-1024x606.png)

Part2-1024x606.png)

Part1-1024x606.png)