Our oceans provide a range of goods and services, many of which depend on healthy ecosystems. The production of seafood, for local consumption, or for trade as a soft commodity, is one of the most widely recognized blue economy services that a healthy ocean provides.

However, unsustainable fishing is currently the greatest threat to the health of ocean ecosystems and is compounded by issues like climate change and habitat destruction. At the same time human rights, worker safety and labor violations in both aquaculture production and wild capture are increasingly, and appropriately in the media spotlight. These nature, climate and social issues, while often hidden through complex, opaque, and transnational supply chains, can present significant reputational, market and regulatory risks both to seafood companies, as well as the financial institutions (FIs) who provide them with capital.

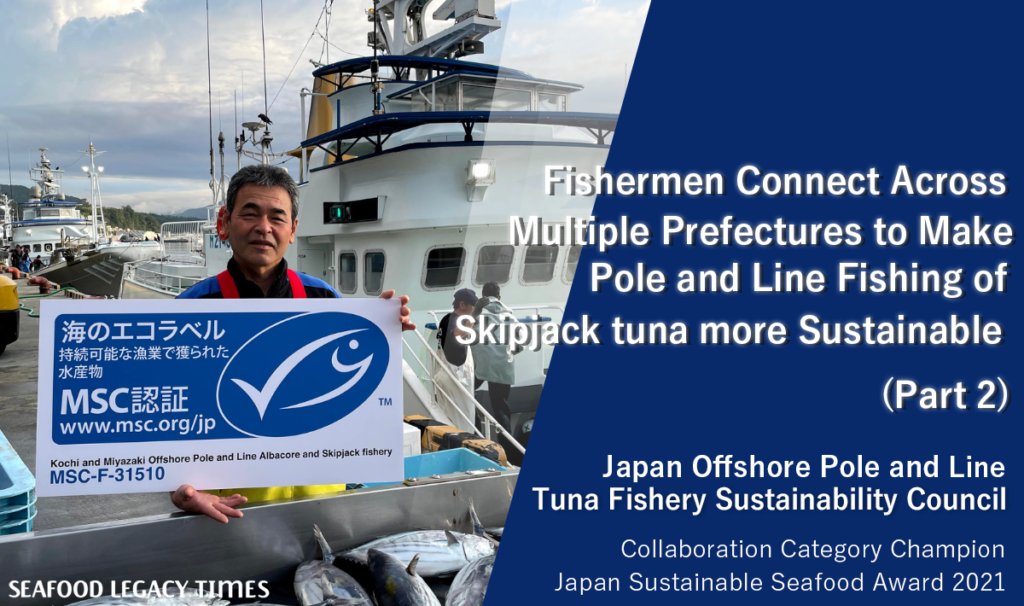

For a country like Japan, which is both a major consumer and producer of seafood, ensuring the sustainability of the seafood industry is critical not just to the health of the oceans, but also to those who depend on them for food and livelihoods. What’s more, Japanese banks – as major lenders, advisors to and investors in companies across the seafood value chain – are potentially exposed to all of the above-mentioned risks whilst also being uniquely positioned to drive improvements in industry performance.

2021 research by the World Wide Fund for Nature (WWF) and Metabolic found that approximately US$1.93 – 2.89 trillion of seafood-related assets and revenues may be at risk over the next 15 years as a result of nutrient pollution, excess fishing efforts, reductions in habitat quality, and disease outbreaks, as well as other factors. While significant strides have been made in recent years to address climate-related risks in investment portfolios, a recent analysis by the World Benchmarking Association (WBA) found that fewer than 5% of financial institutions (FIs) acknowledge having a process to identify the impacts of their financing activities on nature.

Japanese companies and their financiers may be particularly exposed to these risks. 2020 research by Planet Tracker found that the environmental impacts of intensive seafood production “is beginning to be reflected in the financials of the largest seafood companies” – of which the largest proportion are Japanese. And already, Japanese wild capture and aquaculture production are in decline – falling by 85% between 1985 and 2017 – in large part due to excess pressure on marine resources, according to Planet Tracker.

Recognizing the powerful role that financial institutions can play in shifting the global economy towards more sustainable business practices, the World Wide Fund for Nature’s Singapore Sustainable Finance team (WWF-SG) has been assessing and publicly reporting on banks’ environmental and social (E&S) integration progress through its annual Sustainable Banking Assessment (SUSBA) since 2017 2 .In 2020, WWF added sector specific assessments to dig deeper into the scope and quality of banks’ E&S integration approaches for key sectors, starting with energy and palm oil.

In 2023, seafood was added as a third sector, given its growing importance as a key source of protein, along with the increasing ESG challenges the sector faces. In its baseline seafood sector assessment, WWF-Singapore analyzed the public disclosures of 41 major seafood lenders3 to understand how banks are currently managing environmental and social (E&S) risks in their seafood portfolios, and where, specifically, additional support may be most needed. Nine Japanese banks, making up over 20% of the group, were included in this analysis.

WWF’s research found that while many banks are aware of the need to manage E&S risks in the sector, current policies – where they exist – are insufficient to prevent and manage their exposure to such risks. (Above Board: 2022 Baseline assessment of banks’ seafood sector policies)

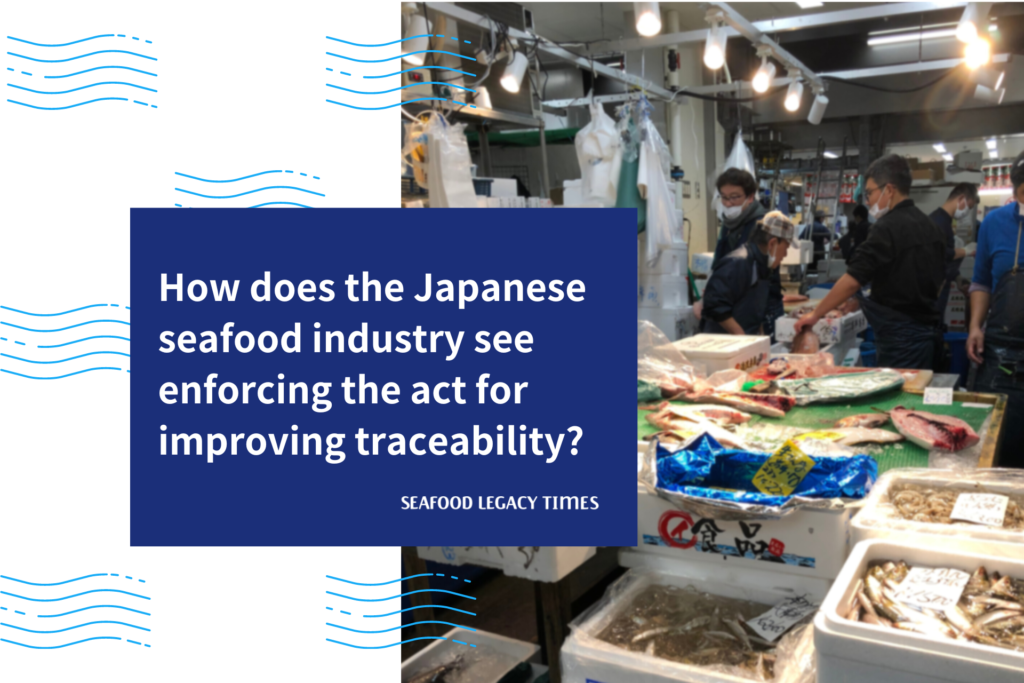

1. Just over half of assessed banks publicly recognise that there are E&S risks associated with seafood; but only 20% have disclosed seafood sector policies. Of those with disclosed policies, banks’ expectations for wild-catch production clients are the most developed, for example, some included recommendations related to sustainability certifications like MSC and ASC, and commitments to eliminate IUU and assure the protection of human and labor rights. Expectations for aquaculture production clients and downstream clients, on the other hand, tended to lack important details, such as commitments to document harvesting control strategies, undertake carrying capacity and environmental impact assessments, put in place processes to minimize risks associated with non-native and genetically altered stocks, and ensure sustainability of feed sourcing, among others. Of the nine Japanese banks assessed, none currently disclose seafood sector policies.

2. While nearly all of the banks assessed – 98% – offered green financial products (green bonds, loans, sustainability-linked loans), most are presently geared towards addressing climate-related risks in the energy sector, with far fewer products yet designed to support food systems sustainability or the blue economy in particular. That said, momentum in this space is growing, with seven of the assessed banks (17%) (including three Japanese banks) having already developed such products for the seafood sector specifically.

Finally, just five of the banks assessed – 12% – currently participate in commitment-based sustainable seafood finance initiatives, such as the Ocean Risk and Resilience Action Alliance (ORRAA) and the UNEP FI Sustainable Blue Economy Finance Initiative (SBE FI). However, none of the assessed Japanese banks were participating in such initiatives at the time of the assessment.

The next few years will be critical to accelerating the transition to a sustainable ocean economy, if we are to meet the SDG14 – life below water – 2030 target and the targets outlined under the Global Biodiversity Framework and the Paris Agreement. As momentum around managing climate and nature-related risks continue to grow, and more countries commit to protect and sustainably manage our marine resources, banks must ensure that they are effectively managing their own exposure to seafood-related E&S risks, and that they are proactively seeking out opportunities to invest in nature-positive solutions.

Japan’s banks are not alone in having a nascent approach – and no disclosure to date – to addressing ESG risks and opportunities in the seafood sector; but they are uniquely well-positioned to take a leadership role in promoting more sustainable practices in the industry. In particular, as frameworks like the recommendations of the Task Force for Nature Related Financial Disclosures (TNFD) are finalized and published later this year, we expect banks to begin expediting the development of associated policies for managing ESG risks, especially in sectors like seafood where companies so clearly depend on healthy natural capital. Therefore, to mitigate potential exposure to E&S risks in seafood portfolios as well as capture the opportunities of the transition to sustainable seafood, Japanese banks can, and should:

1. Develop and disclose seafood sector policies that align client expectations with best-practice guidance and recommendations from the UNEP FI SBE FI (see especially indicators 2.1.1 – 2.4.5 in the Above Board framework);

2. Consider addressing seafood-related E&S risks as a part of broader, bank-wide thematic policies related to biodiversity, climate, deforestation and human rights;

3. Regularly assess their seafood client portfolios for potential exposure to E&S risks and actively engage with clients to support sustainability improvements;

4. Consider extending their financial crime policies and processes to include illegal, unreported and unregulated fishing practices (IUU); and

5. Leverage their existing green finance frameworks to develop targeted “blue” financial products to support the transition towards more sustainable seafood

There is mounting evidence that current unsustainable and illegal practices across the seafood sector are creating substantive environmental, social and financial risks, the consequences of which are being felt throughout supply chains and by those who finance them. At the same time, it has also become increasingly clear that the finance sector has a significant role and responsibility to transition the seafood sector away from destructive and illegal practices and towards more resilient, accountable and sustainable systems; yet it has thus far been slow to respond.

To support financial institutions in implementing the above recommendations, WWF has developed a self-paced e-learning course – Seafood Sustainability 101 for Finance Professionals — which is currently free and open for enrollment. WWF, in partnership with Seafood Legacy, also conducted a webinar for Japanese financial institutions on April 21st. 170 individuals, including representatives from 20 financial institutions, were engaged via the webinar

In addition to the research on banks’ approaches to addressing climate and nature-related risks in their seafood lending portfolios, WWF has also recently published research on how international asset managers – including 15 Japanese investors – are addressing these issues. WWF, as part of a coalition of five conservation and biodiversity-focused organisations, has also recently launched an initiative that will leverage the power of investors to engage seafood companies on critical nature and biodiversity related impacts and risks.

Throughout 2023, WWF will seek to engage bilaterally with those financial institutions included in these baseline assessments to support the translation of these recommendations into organizational policies and approaches, with an annual progress update planned for next year.

For more information about any of the above-mentioned research or initiatives, please contact <info@seafoodlegacy.com> .

Manager, Ocean ESG, WWF-US

Lauren Meghan Lynch

-1024x606.png)

_-1024x606.png)

1_修正524-1024x606.png)

.2-1024x606.png)

2-1024x606.png)

-1-1024x606.png)

Part2-1024x606.png)

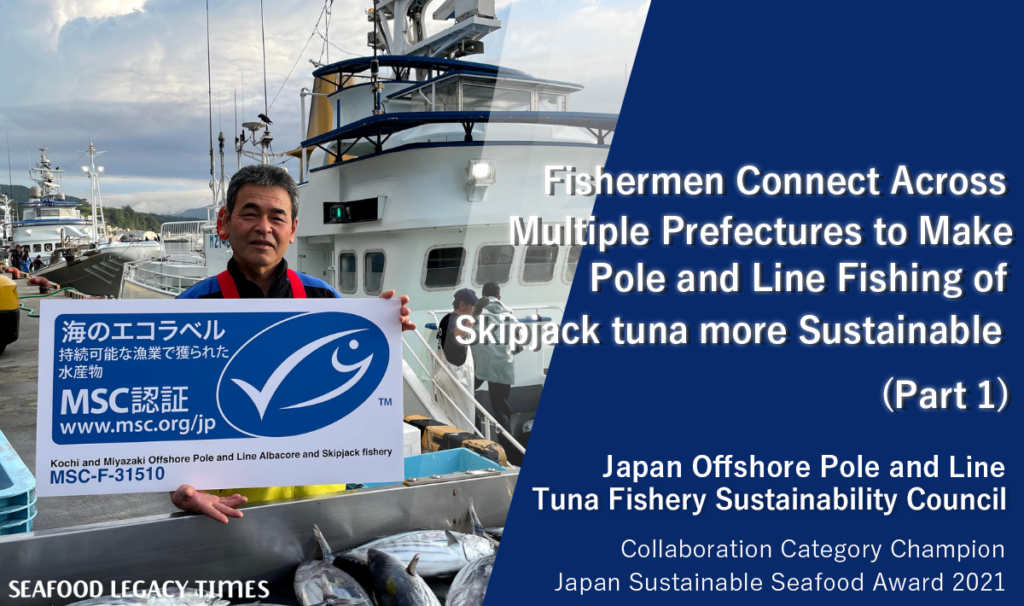

Part1-1024x606.png)