In the first part of this interview, Kotaro Sueyoshi talked about the challenges of issuing blue bonds and the growing demand for sustainable finance options such as Sustainability Linked Loans (SSLs). In the second part, we will discuss sustainable finance options that can be used by small and medium-sized enterprises in the fisheries industry, as well as the significance of providing loans that support SDG initiatives.

Mr. Sueyoshi will also share his thoughts on the Task Force on Nature-related Financial Disclosures (TNFD), the biodiversity version of the Task Force on Climate-Related Financial Disclosures (TCFD), which promotes climate change-related disclosures with an eye toward carbon neutrality.

——How can the fisheries industry better leverage investments?

99% percent of Japanese companies are categorized as small or medium-sized enterprises, with the agriculture, forestry, and fisheries industries having a particularly high number of small businesses. These small and medium-sized businesses may often obtain loans from agricultural cooperatives and fishery cooperatives, and not so many times from traditional banks.

Publicly offered bonds such as blue bonds are an appropriate financing option for relatively large businesses, while smaller businesses can consider other funding alternatives. For instance, Mizuho Bank provides SSLs to small and medium-sized businesses. We evaluate SSLs in compliance with international principles rather than relying on rating agencies, so businesses seeking to raise funds can set up SSLs without incurring evaluation fees.

SSLs allow companies to set sustainability-related targets and receive a reduction in interest rates upon achieving them. These loans offer small and medium-sized businesses a chance to publicly demonstrate their commitment to sustainability by setting goals that align with their work, such as protecting marine biodiversity or upholding human rights in ocean-related matters.

We also lead an SDGs Promotion Support Finance initiative. Through this program, we encourage companies to assess their own initiatives and make an SDGs declaration to reinforce their strengths and address their challenges. Small and medium-sized companies that are just starting their sustainability efforts can receive funding by selecting and declaring which of the 17 goals and 169 indicators of the SDGs they plan to focus on, instead of setting overly ambitious numerical targets.

The SDGs Promotion Support Finance initiative was launched in collaboration with the Tokyo Metropolitan Government to provide institutional loans leveraging Tokyo’s guaranteed lending system from credit associations, resulting in reduced guarantee fees. Mizuho Bank monitors companies’ progress on their SDGs declarations regularly and offers support to help them achieve their goals.

Financial institutions offer various methods of financing that can be used by businesses of all sizes. It is important for companies to consider how to secure funding for sustainability initiatives that align with their financial situation. This is also true for the fisheries industry, and as a financial institution, we must communicate that message to our clients.

SSL and SDGs Promotion Support Finance for SMEs offered by Mizuho Bank

SSL and SDGs Promotion Support Finance for SMEs offered by Mizuho Bank

——What role do you think financial institutions can play in promoting sustainability in the fisheries sector?

Financial institutions can help companies in the fisheries industry promote sustainability by providing them with the necessary funds. To do so, financial institutions must be able to assess which initiatives are truly effective in advancing sustainability.

Mizuho is at the forefront of transition finance, providing support to companies that are committed to implementing long-term strategies to reduce greenhouse gas emissions and achieve a decarbonized society. This is because our extensive industrial and environmental knowledge allows us to assess corporate initiatives accurately. To promote sustainability in the fisheries sector in the future, I would like to build up similar knowledge on natural capital as well.

One crucial role of financial institutions is to communicate to society the legitimacy of the companies we finance by recognizing sustainable initiatives in the seafood industry. By offering funding to such initiatives, Mizuho can serve as a model for other organizations, indicating that these businesses are trustworthy investments and encouraging a steady flow of funds toward them.

——The TNFD framework is scheduled to be announced in the fall of 2023. What changes are expected in investments in natural capital, including the ocean, as a result of this announcement?

We can look at the Task Force on Climate-Related Financial Disclosures (TCFD) as an example of promoting disclosure in decarbonization. The TCFD was established following negotiations based on scientific evidence provided by the Intergovernmental Panel on Climate Change (IPCC), which led to the creation of the United Nations Framework Convention on Climate Change (UNFCCC) and the Paris Agreement. These agreements established methods for measuring greenhouse gases and Science-Based Targets (SBTs) for addressing climate change. The TCFD is a framework for companies to disclose information relevant to climate change. Financial institutions are entering a new era where the information disclosed and integrated under this framework is combined with financial data to facilitate dialogue with clients.

For biodiversity, the Kunming-Montreal Biodiversity Framework was adopted at the 15th Conference of the Parties to the Convention on Biological Diversity (COP15) in 2022. This framework sets “SBTs for Nature” that, like those for climate change, are based on scientific evidence. However, a challenge in the biodiversity field is the lack of measurement methods that can quantify the situation. The final framework for the TNFD was announced this fall, but it will be necessary to concretely develop and implement methods that can quantify biodiversity to ensure the widespread adoption of these initiatives.

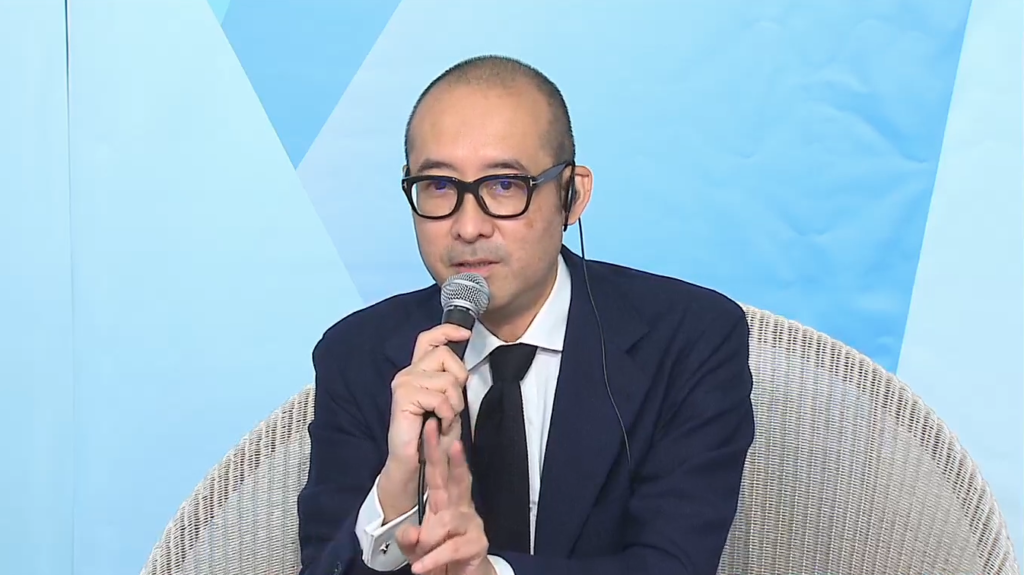

At TSSS 2022 (Tokyo Sustainable Seafood Summit 2022)

At TSSS 2022 (Tokyo Sustainable Seafood Summit 2022)

Biodiversity is a complex issue that is difficult to quantify. However, since the economy relies on natural capital, I expect that the TNFD will function similarly to the TCFD once the system is put in place. Assuming that the guidance for SBTs for Nature is finalized by 2025, I anticipate that the TNFD will gain momentum and progress swiftly.

——What kind of initiatives does Mizuho Financial Group’s Sustainable Business Department plan to undertake in the future in relation to sustainability in the fisheries sector?

Although we have not finalized concrete plans yet, our vision is to help create a sustainable future, including the conservation of our oceans. To achieve this, we aim to provide risk capital to innovative and transformative initiatives and work alongside them as the co-creators of these pioneering ventures.

Over the next decade, Mizuho plans to invest ¥50 billion to promote new technologies and business models that facilitate sustainability in the fisheries sector and other areas. We aspire to support the growth of the fisheries industry as a promising field in the years ahead.

Kotaro Sueyoshi

After joining Mizuho Bank, Ltd., he worked in corporate sales for large corporations, international operations, and business planning for domestic corporations. Since 2018, along with the digitization of the banking business for corporations, he has led the SDGs Business Desk that he established, and is promoting business development support for solving social issues and impact investment and financing. He has been in charge of sustainable business planning for corporations since 2021.

Original Japanese text by: Shino Kawasaki

-1024x606.png)

_-1024x606.png)

1_修正524-1024x606.png)

.2-1024x606.png)

2-1024x606.png)

-1-1024x606.png)

Part2-1024x606.png)

Part1-1024x606.png)